Diverse Teams

HireVue

Using video interviewing technologies to reduce unconscious bias

Diversity is a central priority for many companies – however, businesses frequently struggle to find ways to expand their hiring pipeline, find more diverse candidates, and reduce unconscious bias in hiring decisions. HireVue’s core business model helps solve these challenges.

In October 2019, Carlyle Partners VII partnered with HireVue, a tech company which provides virtual interviewing and assessment technologies to help companies find the most qualified and diverse candidates more quickly. The effectiveness of the technology is core to HireVue’s value proposition, which has several unique components:

- HireVue’s tech platform helps companies cast a wider net: instead of only sending recruiters to top tier universities for example, HireVue customers can screen video interviews from a wider array of potential applicants – their customers see up to 2x more candidates because they’re not limited by geography or scheduling issues

- HireVue creates a more consistent process: traditional screening practices, such as resume scans, are inconsistent. Structuring the interview process from the start brings consistency and fairness resulting in better, more inclusive hiring

- And finally, HireVue reduces unconscious bias: HireVue’s technology seeks to eliminate unreliable and inconsistent variables, such as which university or college was attended or grade-point average, neither of which has been proven to be predictive of job success

- Candidate assessments aren’t impacted by conscious and unconscious human biases that can have an adverse impact on even the most highly qualified candidates based on factors such as race, age, or gender. Each candidate is evaluated in precisely the same way based solely on job-specific competencies. The technology provides unbiased and highly predictive information that human recruiters then use to make hiring decisions

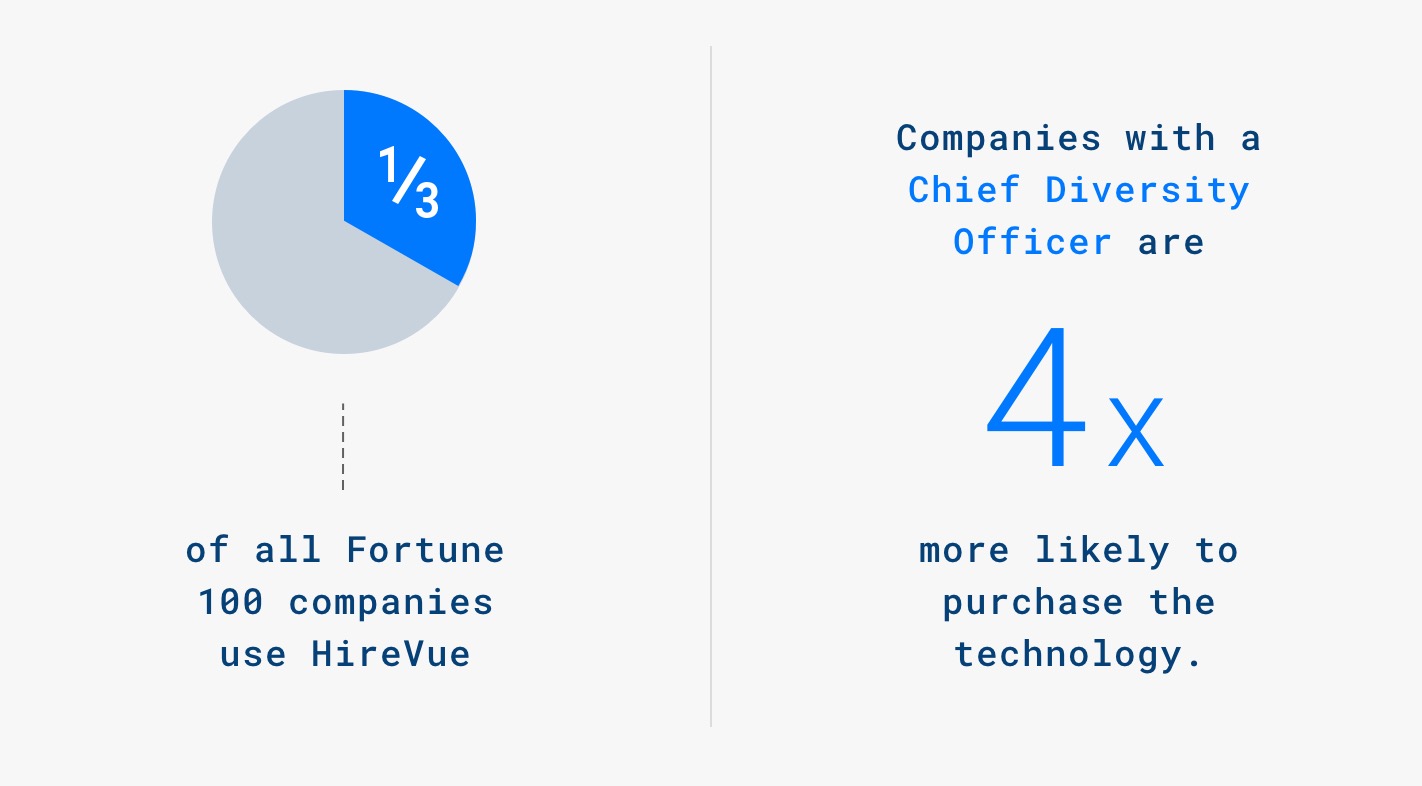

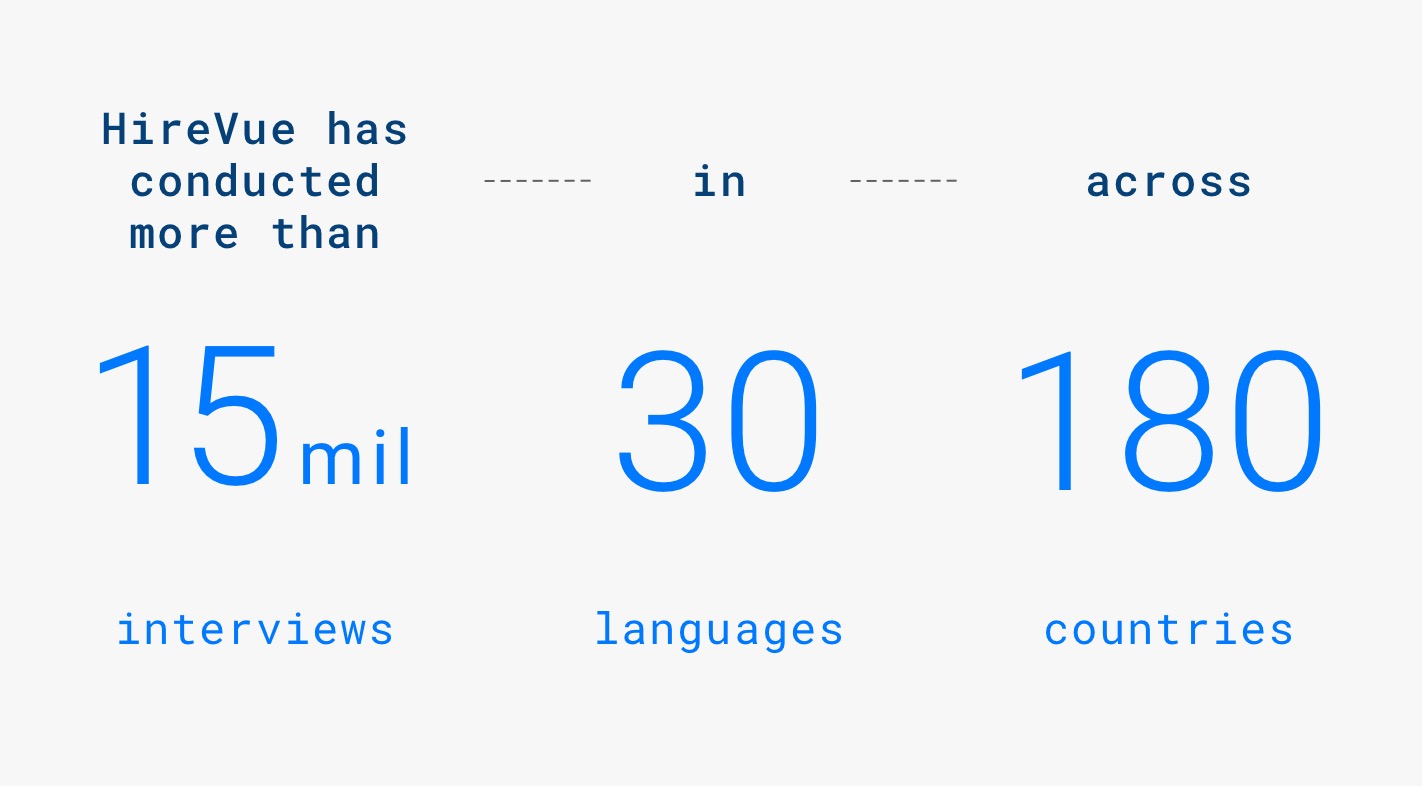

The results have been clear: more than one third of companies in the Fortune 100 use HireVue, and companies with a Chief Diversity Officer are 4x more likely to purchase the technology. As of June 2020, HireVue has conducted more than 15M interviews in 30 languages across 180 countries and is experiencing exponential growth, in no small part because they reduce the cost per hire by almost 25% on average, for their customers.

One of HireVue’s 700+ customers is Unilever, a large, global consumer-packaged goods company, which achieved 50/50 gender balance across its global management team in 2020. In their first year as a HireVue customer, Unilever increased the diversity of its hires by 16%, while also saving more than a million British sterling pounds a year and reducing time spent recruiting by more than 75%.

Diversity and inclusion has become a business priority across industries, which in turn has created a compelling new growth market for a business such as HireVue, which is distinctively positioned to address this challenge effectively, leading to a better – and more diverse – hiring process.

Carlyle believes these selected case studies should be considered as a reflection of Carlyle’s investment process, and references to these particular portfolio companies should not be considered a recommendation of any particular security, investment, or portfolio company. The information provided about these portfolio companies is intended to be illustrative, and is not intended to be used as an indication of the current or future performance of Carlyle’s portfolio companies. The investments described in the selected case studies were not made by any single fund or other product and do not represent all of the investments purchased or sold by any fund or other product. The information provided in these case studies is for informational purposes only and may not be relied on in any manner as advice or as an offer to sell or a solicitation of an offer to buy interests in any fund or other product sponsored or managed by Carlyle or its affiliates. Any such offer or solicitation shall only be made pursuant to a final confidential private placement memorandum, which will be furnished to qualified investors on a confidential basis at their request.