Better Businesses Have

Climate Resilience

Climate change is one of the most pressing issues of our time, creating unprecedented risks and opportunities for businesses across all industries. Companies that can navigate these emerging challenges – from physical risks to policy shifts and technological disruptions – and seize the mounting opportunities of the energy transition, we expect will have the climate resilience to thrive in a changing world.

Case Studies Featured

In 2019 we formed a team of 9 dedicated renewable investment professionals

Electricity generation is one of the largest sources of global greenhouse gas emissions, accounting for approximately 28% of U.S. emissions alone – almost two-thirds of our electricity comes from burning fossil fuels. As renewable energy costs continue to fall, regulations tighten, and the energy transition accelerates, however, there is a large and growing investment opportunity in building the renewable energy capacity required to power a lower-carbon US electricity grid.

In 2019 Carlyle’s Renewable and Sustainable Energy Platform led a $100 million commitment to partner with Alchemy Renewable Energy on a newly-established company, Cardinal Renewables, to develop, acquire, finance and operate solar power generation projects throughout the United States – including a dozen operating assets and a pipeline of development projects.

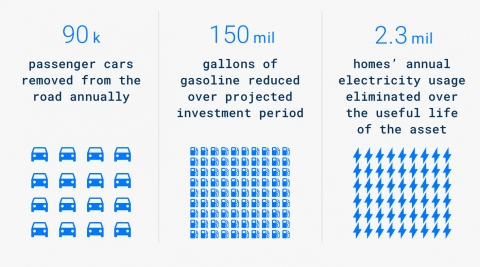

Cardinal Renewables Portfolio Greenhouse Gas Emissions Potential Abatement Capacity.

The world is undergoing a massive energy transition – Societal expectations about how energy is produced and used are changing rapidly, and governments around the world are increasingly taking action to meet their climate goals under the Paris Agreement. With a global population set to grow to more than nine billion by 2050, however, the world continues to need more energy than ever.

An overlooked part of the energy transition: the shifting Oil & Gas business model

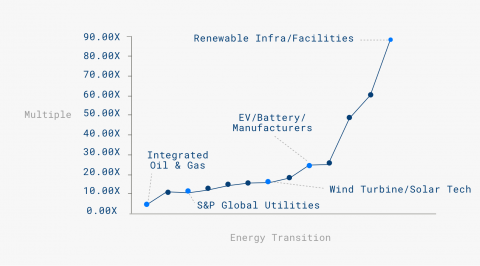

As public fears of the nearer-term consequences of climate change have intensified, enormous disparities in energy sector multiples have emerged.

Today, the valuation assigned to a given energy company largely depends on where its assets sit on the clean energy spectrum (see graphic), creating compelling financial incentives to accelerate the energy transition through diversified energy companies – not solely through pureplay renewable energy developments

Valuation Multiples Have Adjusted to Energy Transition Risk in Advance of Changes in Fundamentals

Thanks to no longer holding periods and investment horizons, companies backed by private capital tend to invest more than their public counterparts and that investment tends to be more sensitized to changes in relative valuations. These climate-related shifts in asset prices incent private investors to reduce carbon footprints and deploy capital into green energy and related storage technology.

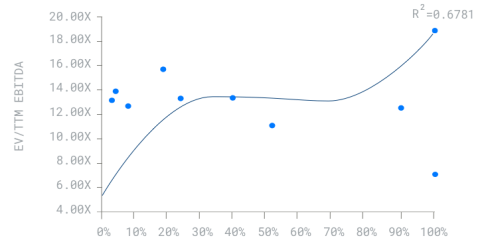

Increasing renewables’ (photovoltaic solar and wind) share of total revenue from zero to 40% could lead to a doubling of the typical energy company’s trailing Ebitda multiple (see graphic).

Adding Renewables Capacity to O&G Assets Can Produce Significant Multiple Expansion

Q&A

Pooja Goyal, Co-Head of Carlyle’s Infrastructure Group, shares perspectives on the opportunities in the renewable energy market

To paraphrase an old saying, if you show me a well-managed sustainability program, I’ll show you a well-managed company, Accolade Wines is very much both: their UK business won not only the coveted Manufacturer of the Year in 2018, but also the Sustainable Manufacturing category from the Manufacturer MX Awards in 2018 & 2019.

Accolade is acutely aware of the impact climate change can have on their crops, and hence their core business. So Accolade has gone after the issue of climate with strategy and focus. They have honed in specifically on understanding and reducing their own potential contributions to carbon emissions – managing sustainability and their core business in tandem.

2.5 megawatt wind turbine on-site

When it comes to real estate, efficient use of energy and water isn’t just an environmental concern – it has a direct link to the bottom line. That’s why our US Real Estate group approaches sustainability as an operational issue, rather than a way to add green window-dressing to their properties.

Our Impact at Carlyle

What we’re doing at Carlyle on Climate Resilience

Carbon neutrality

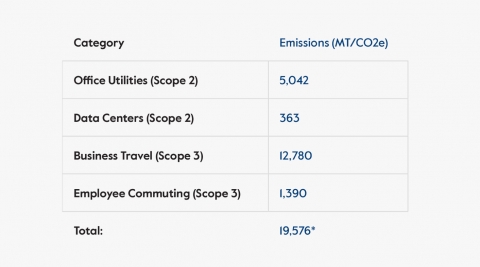

2019 was Carlyle’s third year of carbon neutrality across our 32 global offices and the activities of our more than 1,750 employees, after we became the first major private equity firm to make a carbon neutrality commitment in 2017. Using the World Resources Greenhouse Gas (GHG) Protocol, we focused on the material sources of emissions for our firm: office utilities, offsite data centers, commercial and private air travel, and employee commuting. In 2019 we emitted 19,576 metric tonnes of carbon dioxide equivalent across those categories, detailed in the table below. As in prior years, we offset our emissions by purchasing carbon offsets in truck stop electrification projects in the US through The Carbon Fund, which were verified by the American Carbon Registry.